If you’re like most homeowners, chances are you’ve opened your property tax bill and felt your stomach drop. Those numbers can feel overwhelming, especially when you’re not sure how they were calculated. The good news? You have more control over your property taxes than you might think. With the right approach, you can lower your property tax burden and keep more of your hard-earned money where it belongs—your pocket.

Let’s break down some simple, powerful strategies that can help you reduce your property taxes quickly and legally.

1. Understand How Property Taxes Work

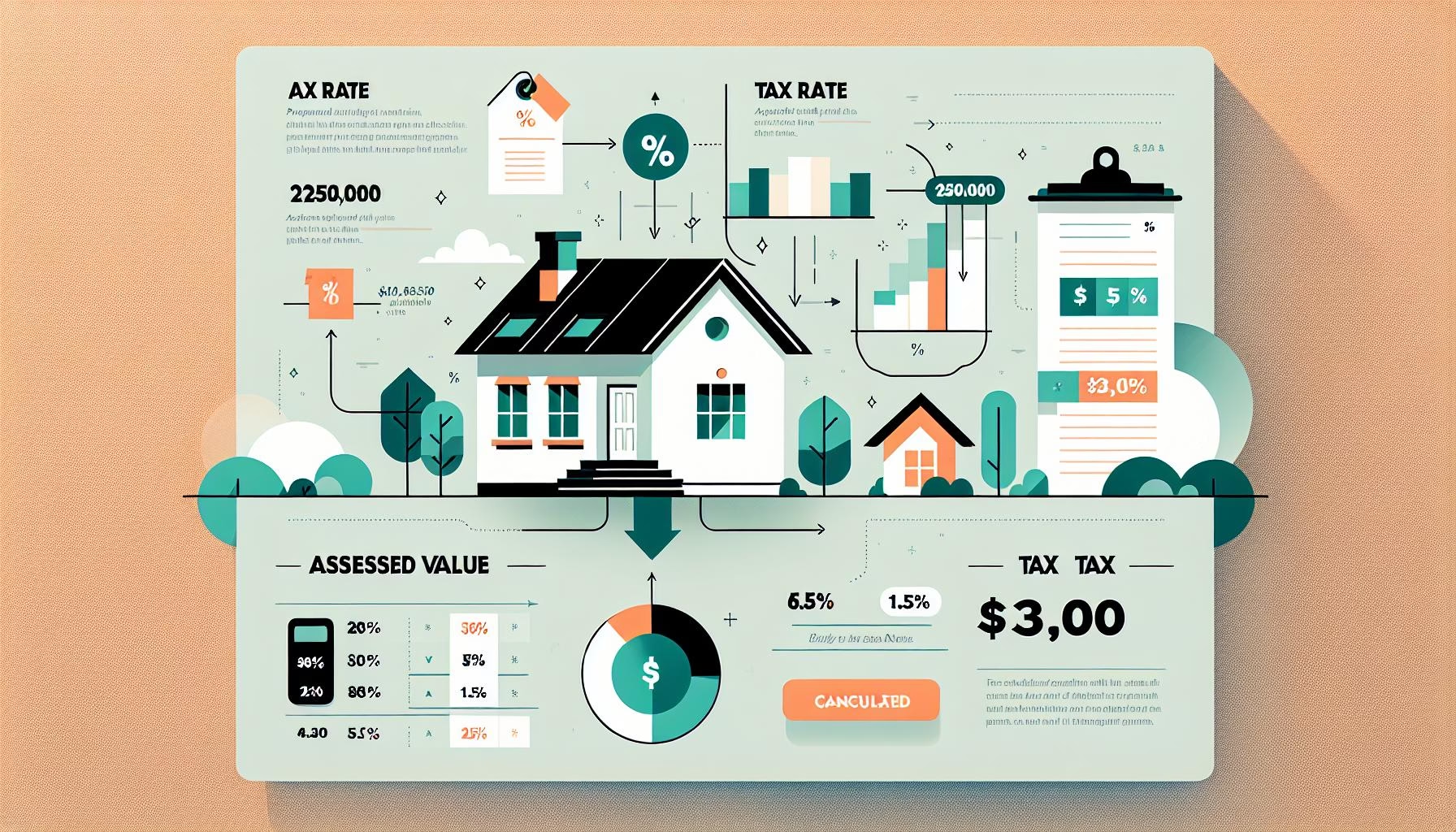

Before we dive into tax-saving tips, it’s important to understand what property taxes are and how they’re calculated. In simple terms, your property tax is based on two things:

- Assessed value of your home – what the local government thinks your home is worth.

- Tax rate (also called a mill rate) – the percentage used to calculate what you owe.

So, the higher your home’s assessed value, the more taxes you pay. That’s why most of the tips below are all about dealing with that assessed value.

2. Review Your Property Tax Assessment

Many homeowners are surprised to learn that mistakes can happen on property assessments all the time. So don’t just accept that bill at face value!

Take a closer look at your assessment notice. It should include details like your home’s square footage, number of bedrooms and bathrooms, improvements, and lot size. If anything looks off—say they list an additional bathroom you don’t actually have—that could mean an inflated tax bill.

Action Step: Request a formal review from your local assessor’s office if you spot inaccuracies. You’ll typically have a limited time to make this appeal—usually 30 to 90 days after receiving your bill—so act quickly.

3. Compare With Similar Properties

Ever heard the saying “Don’t compare apples to oranges”? That applies here too. If your home is being compared to much newer or larger homes in your neighborhood, your assessed value could be too high.

Take a look at nearby houses that are similar in size, style, and condition. Are their tax bills lower than yours? If so, you may want to dig deeper.

You can often get this info online through your county’s property records. If you notice a pattern, that’s good evidence for your appeal.

4. File a Tax Appeal

If your assessment seems unfair, you can officially challenge it. This is called filing a property tax appeal. Don’t worry—it’s not as scary as it sounds.

Most counties have a fairly simple process in place, and you don’t necessarily need a lawyer. You’ll just need to gather proof that your home was over-assessed (like sales of similar homes in your area or photos showing necessary repairs).

Tip: If you’re successful, your taxes could drop significantly—not just for one year, but for several.

5. Take Advantage of Tax Exemptions and Relief Programs

Here’s where things can get especially helpful. Many states offer property tax exemptions or relief programs to eligible homeowners. These might include:

- Homestead exemptions for primary residences

- Senior citizen exemptions

- Veteran or disability exemptions

- Low-income homeowner relief

Each state has different eligibility rules, so check with your local tax assessor’s office to see what you qualify for. These exemptions can substantially reduce your property tax bill.

Want to learn more about deductions you might be missing? Check out our post on the top tax deductions for homeowners.

6. Avoid Costly Home Improvements That Increase Value

Planning to remodel your kitchen or add that dreamy sunroom? It might make your home more enjoyable—but be mindful that it could also raise your assessed value.

The bigger or more modern your home becomes, the more it’s worth in the eyes of your tax assessor. That means higher taxes.

If you’re thinking long-term, remember to weigh the value of updates against the potential hike in your property tax.

Smart Tip:

Not all improvements affect your taxes. For example, repairs like fixing a broken roof might not raise your assessment. Always check before starting major upgrades.

7. Hire a Professional

If you’ve tried everything and still feel like your taxes are too high, consider bringing in a property tax consultant. These professionals specialize in reviewing assessments and filing successful appeals.

The best part? Many of them only charge a fee if they actually save you money. So it’s a low-risk move that could lead to long-term savings.

Still unsure whether a professional is worth it? Do a quick calculation: If you’re overpaying by $1,000 or more each year, it may be time to get some expert advice.

Conclusion

No one enjoys dealing with taxes, but understanding how to lower your property tax burden is easier than you might think. By taking just a few proactive steps—like double-checking your assessment, applying for exemptions, and avoiding over-the-top renovations—you can keep more money in your wallet each year.

Remember, every little bit helps when it comes to household budgets. Start with one tip above and see where it leads!

Want more great advice on taxes and saving money as a homeowner? Be sure to check out our other helpful content in our Homeownership Blog.

To read the full original article that inspired this guide, visit Investopedia’s Property Tax Guide.